NKSJ Holdings Inc.

Enjoy special products from all over Japan!

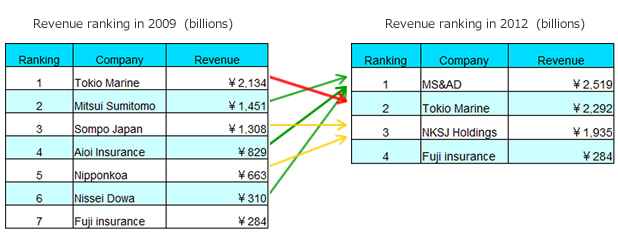

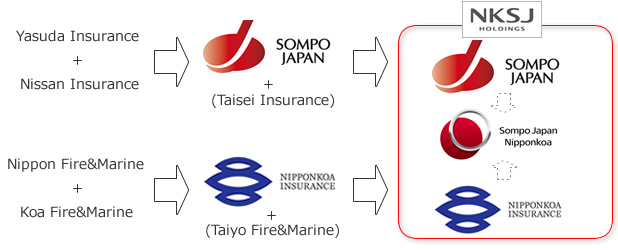

NKSJ Holdings Inc(TYO:8630) is the one of the top three general insurance companies(San-Mega-Sompo) in Japan. It was founded in 2010 by business merger of two companies, Sompo Japan and Nipponkoa Insurance. Then, their revenues and profits decreased because of falling sales of new cars and homes owing to severe recession in 2009. In addition, they concerned losing economies of scale because MS&AD was founded, and Southeastern Asset Management major stock holder of them demanded carrying out a reform. It was the consolidation of the largest scale for them though they were founded by several mergers of the companies. Nowadays State Street Corporation is major stockholder and Mizuho bank hold 1.1% stock. Southeastern Asset Management sold much stock of NKSJ in 2011.

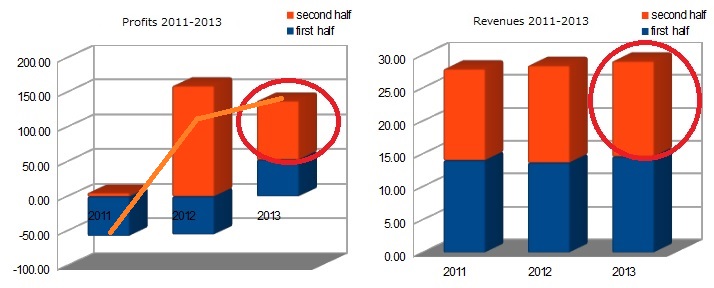

NKSJ's revenue of first half(April-September) in 2013 was one trillion and 459 billion yen (about 14.59 billion dollars), and rose 6.9% from the year-earlier levels. The primary factor of that was earning insurance premium and investment income, especially life insurance company its subsdiary and raising a car insurance premium contributed its revenues.

Its current profits of first half in 2013 was 53 billion yen (about 0.5 billion dollars) and returned profits from the last year. Its prfits forecast in the full year ended March 2014 rose 30% from the last year. However, its forecast may undershoot its budget if investment income droped because of stock market (Nikkei) falling.

The graph of profits shows the deficit of about 0.5 billion dollars in 2011 when Tohoku earthquake and tsunami occered started climbing steadily. On the other hand, NKSJ Holdings is requierd to strengthen corporate governance and internal control to realize corporate value improvement. There were some corporate scandals in the past few years: threre is a omission issuance subordinated debt in materials submitted to the shareholders meeting in 2010, insurance benefit (five million dollars) was unpaid in 2010, Sompo Japan made claims adjuster who didn't have the license investigated insurance claims for Tohoku earthquake and tsunami in 2011, employees lost CD-R recorded 400 thousand customer information in 2012.

Sompo Japan Nipponkoa insurance will be founded by consolidation of Sompo Japan and Nipponkoa Insurance in 2014. Synergetic effect by consolidation will be from now on. There is some expectation its revenues and profits increase little by little for a long term.

Toyota Motor

Toyota Motor Tokio Marine

Tokio Marine MS&AD Insurance

MS&AD Insurance